Welcome to https://frontrunnerbot.io let's start with

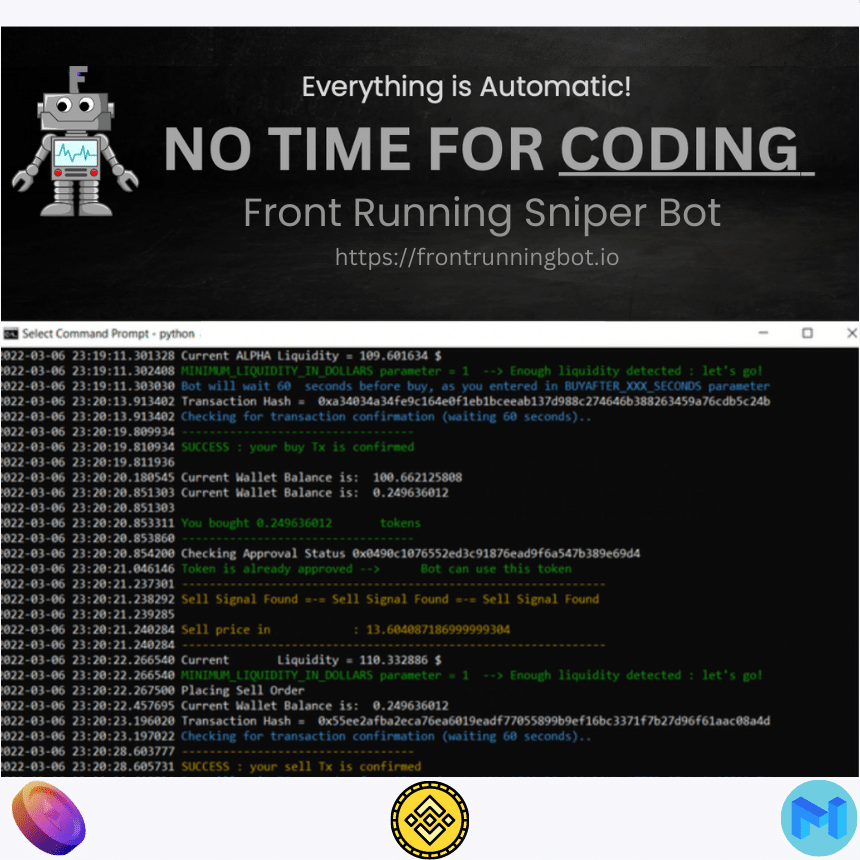

Front Running Bot Automated Front Running Sniper Bot

Scroll Down

To Learn More

Front Running Bot Works on BSC, SOL and ETH chains

How it Works Bot

Step by step usage of the front running sniper bot.

Get the Front Running Bot

You can click to try now front running bot start your free trial.

Choose your plan

If you want to try front running bot select the free trial plan.

Instructions

Follow the instructions installation of the front running sniper bot.

Ready!

Now you ready to start front running sniper bot GUI.

Front Running Bot Works on BSC, SOL and ETH chains

How it Works Bot

Step by step usage of the front running sniper bot.

Get the Front Running Bot

You can click to try now front running bot start your free trial.

Choose your plan

If you want to try front running bot select the free trial plan.

Instructions

Follow the instructions installation of the front running sniper bot.

Ready!

Now you ready to start front running sniper bot GUI.

The Front Running Bot We Are Providing Amazing Features

Features Of The Front Running Sniper Bot

Best front running bot on the market you can try free.

Scan Blocks Temperature

Scanning to mempools for buying the asset at a lower price, before the price to rise.

Find Suitable Transactions

Finding the prioritize transactions blocks with low or high tolerences that pay higher fees.

Place To Buy Order

You can place a buy or sell order with gas slightly lower than X or Y price for profit from transactions.

Profit The Front Run

The bot is finish to scan the mempools for potential transactions now you allowed to buy the tokens.

Why people is using the Front Running Bot, Sandwich Bot, Front Running Sniper Bot

Frequently Asking Questions About Of Front Running Bot

You can get many answers from here about of the Front Running Sniper Bot

What is the Front Running Sniper Bot?

A Front Running Bot is a type of bot software program that takes advantage of the latency in the blockchain network to execute trades ahead of others. The front running bot it works by detecting an incoming large transaction and placing an order in front of it, taking advantage of the expected price movement. This can be considered even use in some cases as it can result in market manipulation and unfair profits for the bot at the expense of other users.

Finding a reliable front-running bot can be difficult, as the practice is often frowned upon and not widely shared. However, some snipe bots do exist and can yield significant profits, such as a user who sniped a launch with front runner bot 20 ETH and made almost 4 times his investment.

We offer a set of code that can be used as-is or modified to suit your needs. The bot can perform front-running, sniping new tokens when liquidity is added, sandwiching transactions, and swarming liquidity snipes with multiple accounts through Uniswap and Pancakeswap.

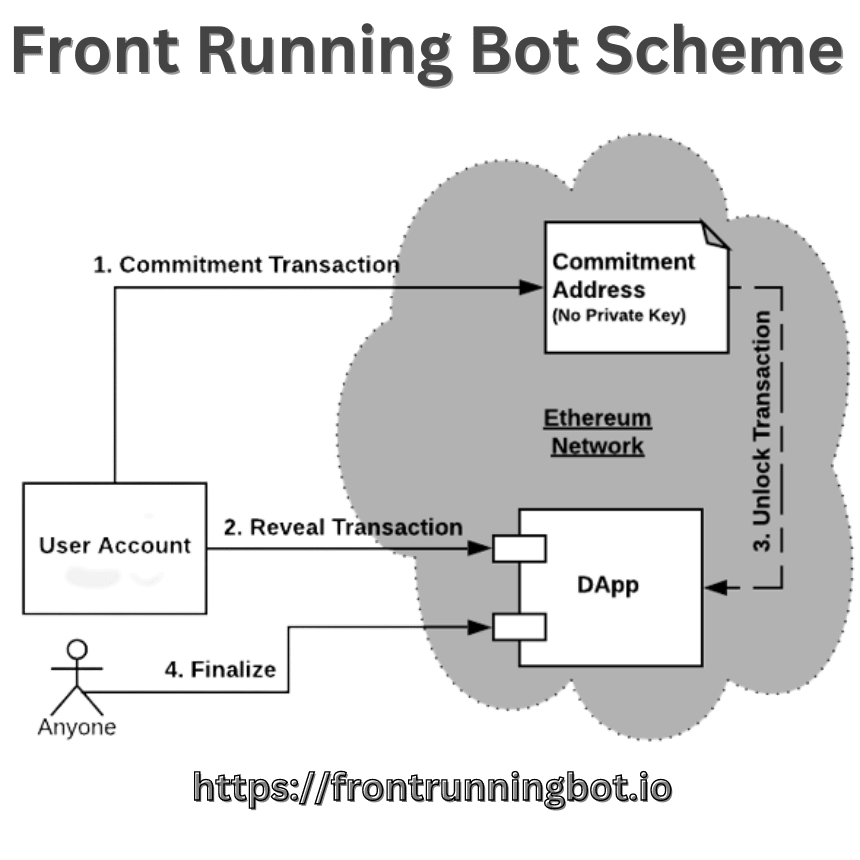

Front running bot in crypto often occurs in the Ethereum environment as transactions are processed in the order of the gas fee, with higher fees taking priority. A front-run bot scans the mempool, finds a suitable transaction, places a buy order with a slightly higher gas fee, and then a sell order with a lower gas fee, profiting from the front-run. The design of Ethereum provides the ideal environment for front-running, making it a popular form of attack known as the “sandwich attack.”

A front running sniper sandwich bot is a type of trading bot that takes advantage of the slippage tolerance in decentralized exchange (DEX) transactions to generate profits. The bot creates a two-leg trade, “sandwiching” the desired trade in between. The bot first buys an asset at a lower price and sells it at a higher price, while also specifying a slippage tolerance. When the first trade is executed, the price of the asset may have changed, and the bot will sell it again at the higher price. This way, the front running sniper bot can potentially generate profits from the difference in price and the slippage tolerance.

Front Running Sniper Bot is Profitable?

Front running is the act of exploiting the latency between the time a trade is placed and when it is executed on a decentralized exchange (DEX) to gain an advantage over other traders. A front running sniper bot can be used to make a profit by taking advantage of this latency to buy and sell assets ahead of other traders, thereby capturing the difference in price.

The profitability of front running bots is highly debated and controversial. Some people may argue that front running bots can be used to exploit market inefficiencies for profit, while others believe that front running is unethical and goes against the principles of a fair market.

The process of sniping with a front-running bot typically involves the bot monitoring the blockchain for high-value transactions and then executing trades in front of them. This can potentially result in profits if the bot is able to buy low and sell high. However, please note that the use of front-running bots is controversial and may be unethical, as it can take advantage of the lack of transparency in the blockchain and result in a negative impact on other users. Additionally, the profitability of front-running bots is not guaranteed and may vary depending on market conditions.

The profit one can make with front running bots is not fixed and can vary widely. The profit depends on many factors such as the current market conditions, the strategy being used, the effectiveness of the bot, and the competition from other traders and bots. It is difficult to estimate the exact profit one can make with a front running bot.

Front Running Sniper Bot is Secure?

The legality of using front-running bots is unclear and depends on the specific jurisdiction and regulations. However, front-running is generally considered unethical and may be illegal in some cases, as it involves exploiting privileged information for personal gain.

It is important to be aware of the regulations and laws in your jurisdiction before using a front-running bot, and to consider the ethical implications of such actions. Before taking any action, it is always best to consult with a qualified legal professional who is familiar with the specific laws and regulations that apply to your situation.

Front running bots can be found in the context of cryptocurrency trading, where they are sometimes used to exploit the speed advantage of trading algorithms in order to profit from price movements in the market. The exact time and circumstances in which front running bots may be used can vary, but they generally involve taking advantage of fast access to information or execution speeds in order to gain an edge in trading.

The practice of front running is generally considered unethical and is sometimes illegal, depending on the jurisdiction. It involves exploiting information asymmetry and using privileged access to trade ahead of other users, leading to unfair advantages and potentially negatively impacting market integrity.

How I Can Use The Front Running Bot?

Our front running bot is have a GUI (Graphical User Interface) and front run bot running totally automated you can setting everything from GUI.

This code creates an express server that listens on port 3888. It connects to a Web3 provider using the WebSockets protocol with the endpoint “wss://your-fastlynode-endpoint”. Another WebSocket provider is also created using the “ethers” library, using the endpoint “wss://5489c137-cd4d-42dd-878d-d366b622cd6f.bscfullnode.com/5489c137-cd4d-42dd-878d-d366b622cd6f/ws”. The code defines an interface for smart contract functions using the “ethers” library. The custom WebSocket provider listens for ‘pending’ transactions and if a transaction is detected to be sent to a specific address “0x10ED43C718714eb63d5aA57B78B54704E256024E”, it extracts the value, gas price and gas limit of the transaction, then adds logic (which is not specified in the code). Finally, the server listens on the specified port.

Here is front running bot example code:

const express = require(‘express’);

const http = require(‘http’);

const Web3 = require(‘web3’);

const ethers = require(‘ethers’);

const app = express();

const PORT = process.env.PORT || 3888;

const web3 = new Web3(‘wss://your-fastlynode-endpoint’);

const wss = ‘wss://5489c137-cd4d-42dd-878d-d366b622cd6f.bscfullnode.com/5489c137-cd4d-42dd-878d-d366b622cd6f/ws’;

async function init() {

const customWsProvider = new ethers.providers.WebSocketProvider(wss);

const iface = new ethers.utils.Interface([

‘function swapExactETHForTokens(uint256 amountOutMin, address[] path, address to, uint256 deadline)’,

‘function swapETHForExactTokens(uint amountOut, address[] path, address to, uint deadline)’,

‘function swapExactETHForTokensSupportingFeeOnTransferTokens(uint amountOutMin, address[] path, address to, uint deadline)’

]);

customWsProvider.on(‘pending’, async tx => {

const transaction = await customWsProvider.getTransaction(tx);

if (transaction && transaction.to === ‘0x10ED43C718714eb63d5aA57B78B54704E256024E’) {

const value = web3.utils.fromWei(transaction.value.toString());

const gasPrice = web3.utils.fromWei(transaction.gasPrice.toString());

const gasLimit = web3.utils.fromWei(transaction.gasLimit.toString());

// Add logic here

}

});

}

init();

app.listen(PORT, () => {

console.log(`Server listening on port ${PORT}`);

});

The code is a Node.js script that listens to Ethereum transactions using the Web3 and Ethers libraries. The script is designed to monitor only pending transactions that are sent to a specific Ethereum contract address and have a value higher than 10 ETH. The script will then log information about the transaction, such as its value, gas price, and gas limit. Additionally, the script will try to decode the function data of the transaction and log information about the token being swapped, such as its address. It’s important to note that the code guarantee profits, as the value of the token being swapped may go up or down.

How do Front Runner Bot Affect To Orders?

How do Front Runner Bot operate?

Front Runner Bot is Particularity?

Front Running Bot Behind Technology?

How You Can Run Front Running Bot?

Is Front Running Bot Legal To Use?

How Front Run Bot Predict Price Move?

Front Runner Bots predict price movements using sophisticated algorithms that analyze real-time data from market orders, trade volumes, and price fluctuations. They look for patterns in the order book—such as large pending trades or price gaps—and use this information to anticipate future price changes. Some bots also incorporate machine learning, allowing them to adapt to market conditions and improve their predictions based on past performance. By leveraging these predictive models, bots can quickly react to changes in the market, placing trades before the price shift becomes noticeable to other traders. The goal is to profit from the price movement triggered by a large trade or sentiment shift, often executing trades milliseconds before others can.

What Makes A Special Front Run Bot?

PDF Version

Front running bot works on BSC, ETH, POLYGON (MATIC)

We offer Perfect Bot Coded With Python

Our front running bot is typically used by individuals or organizations who want to monitor and analyze transactions happening on the Ethereum network, specifically transactions that are associated with PancakeSwap, a decentralized exchange built on the Binance Smart Chain also Polygon (MATIC) network chains. The code listens for any transactions happening on PancakeSwap's factory contract and logs transactions that are worth more than 10 Binance Coin (BNB) Ethereum (ETH) in value. The purpose of this bot is to analyze the data of the transactions and determine whether it's worth front-running, a term used to describe the act of executing a trade ahead of a large order to profit from price movements caused by that trade.

We offer the best front running sniper bot works on all chains

Front Running Bot is Created for you

Front-running is refers to a practice where a trade based on large order that will impact the market. It's possible to front-run transactions on various networks, including Ethereum, Binance Smart Chain (BSC), and Polygon (formerly known as Matic) The level of centralization and transparency of each network can affect the feasibility of front-running and the ease with which it can be detected, some blockchain networks have implemented measures to mitigate the risk of profitability of front-running on different blockchain networks, such as Ethereum, BSC, and Polygon depends on various factors such as network congestion, fees, market volatility, and the level of competition among front-runners.

What our customers says?

Testimonials About Us

Reviews about front running sniper bot.

Click To Next Or Prew Slide

Front running sniper bot pricing and plans

Flexible Pricing plans

Please feel free to give it a try.

Trial

Try for free 30 day with all features.

free

- Ethereum Network

- Avalanche Network

- Binance Smart Chain Network

- Polygon (MATIC) Network

- Bypass Smart Transactions

Lite

You can buy the lite plan for month.

$3900Month

- Ethereum Network

- Binance Smart Chain Network

- Polygon (MATIC) Network

- Bypass Smart Transactions

- Live Support (Telegram)

Professional

Unlock the all features.

$6900Month

- Ethereum Network

- Binance Smart Chain Network

- Polygon (MATIC) Network

- +Avalanche Network (*New Features)

- Bypass Smart Transactions

- Live Support 24/7

- Live Updates 24/7

Get in touch.

Write us a message

Knowledge is

Power

What is a Front Running Bot?

How does a Front Running MEV Bot work?

What is the difference between Front Running and MEV Bots?

Are Front Running Bots ethical?

Can Front Running Bots be used on all blockchains?

How can I avoid getting front run by bots?

To avoid being front-run by bots, you can use a few strategies:

- Use Flashbots: Flashbots provide a way to submit transactions directly to miners, bypassing the public mempool, which helps avoid exposure to front-running bots.

- Increase Gas Fees: Increasing your gas price can sometimes help avoid front-running, as bots generally prioritize transactions with higher fees.

- Slippage Tolerance: Lowering your slippage tolerance when using decentralized exchanges (DEXs) can limit the impact bots have on your trade, but it may result in a failed transaction if the price moves too much.

Is it possible to stop Front Running Bots?

Can I create my own Front Running Bot?

What tools are available to build a Front Running Bot?

There are several tools and libraries that can help you build a Front Running Bot:

- Web3.js – A JavaScript library that allows you to interact with Ethereum nodes and the blockchain directly.

- Eth Gas Station – Provides gas price data to optimize transaction fees for front running.

- Flashbots – A service that provides private transaction bundles, which can help you avoid the public mempool.

- MEV-Boost – An open-source project that allows for building custom MEV bots, with a focus on Ethereum and similar blockchains.

Using these tools, you can create a bot that monitors transactions in the mempool and automatically places orders to capture the maximum extractable value from a blockchain transaction.

What are the risks of using Front Running Bots?

The risks of using Front Running Bots include:

- Legal Risks: Front running is illegal in traditional financial markets, and the legality in the cryptocurrency space is still uncertain.

- Network Risks: Bots can inadvertently contribute to network congestion, causing higher transaction fees or delays in block finalization.

- Ethical Risks: Front running can be viewed as exploitative, leading to negative community sentiment or backlash.

- Financial Risks: Building and running a bot requires upfront investment in development, gas costs, and transaction fees, and there’s no guarantee of profitability.

Note: Front-running bots can sometimes be seen as controversial due to their ability to manipulate the order of transactions for profit, often at the expense of regular traders. While they can be profitable, they can also contribute to network congestion and higher gas fees, potentially creating an unfair trading environment. It’s essential to be aware of these ethical considerations and how different blockchain protocols handle MEV (Maximal Extractable Value) activities.

Table Of Contents

Sitemap

Legal Notices

Terms And Rules

About