Front-running, a practice often associated with traders and bots, involves strategically placing orders before others to capitalize on expected price fluctuations. In the realm of cryptocurrency trading, front-running bots specialize in analyzing pending blockchain transactions and executing trades in advance to leverage price shifts.

To mitigate front-running, some traders opt for private or off-chain transactions, keeping them hidden from public blockchain records. This approach makes it challenging for front-running bots to identify and exploit these transactions. Certain cryptocurrency exchanges have also taken measures to curb front-running, such as introducing transaction processing randomization.

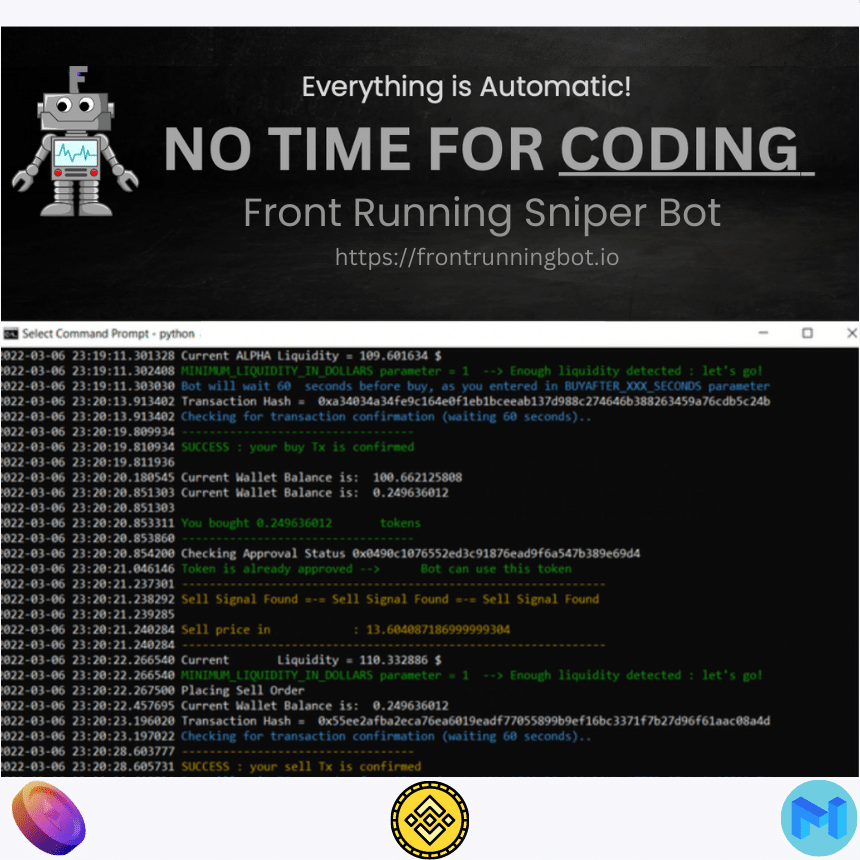

A “screener” for front-running typically refers to a tool or software designed to detect potential trades susceptible to front-running. In the context of cryptocurrency trading, a front-running screener examines pending blockchain transactions, aiming to spot patterns or trends indicating possible front-running activities.

Front-running screeners employ diverse algorithms and techniques for identification. They might seek out large unexecuted orders or scrutinize transaction timing to pinpoint trades executed ahead of others.